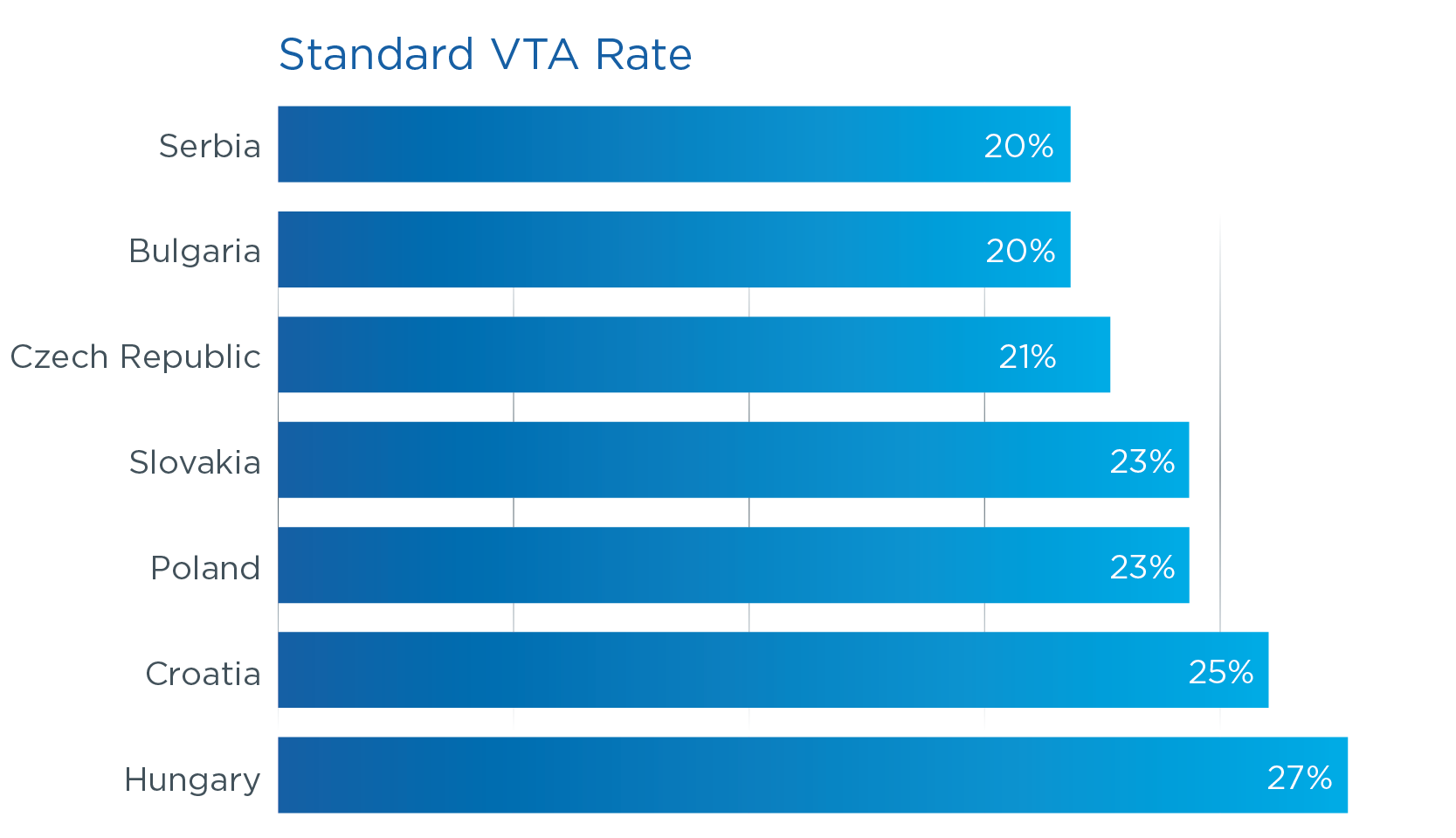

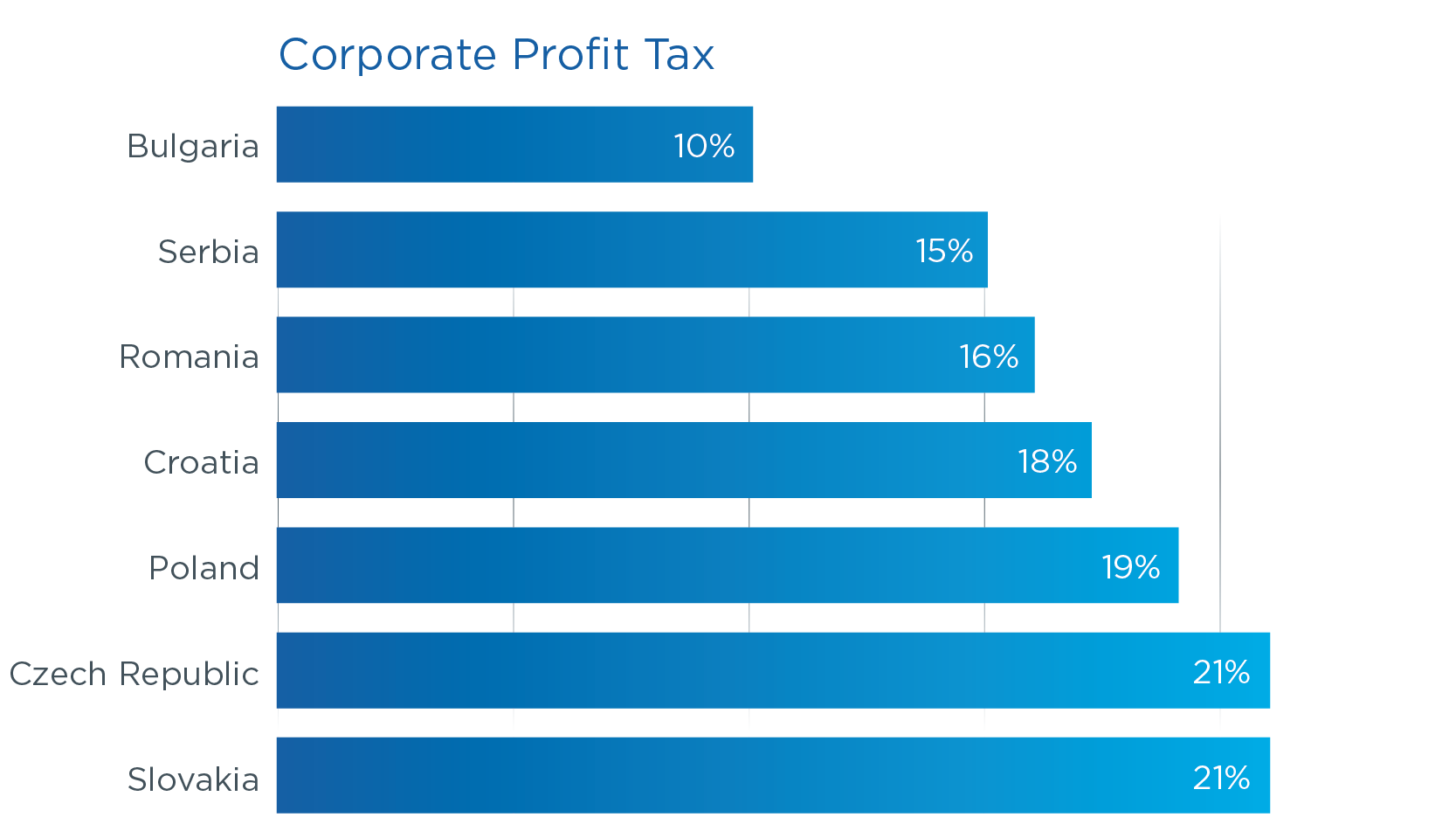

Serbia's tax regime is highly conducive to doing business. The corporate profit tax is among the lowest in Europe, while the Value Added Tax is among the most competitive in Central and Eastern Europe.

The VAT rates are as follows:

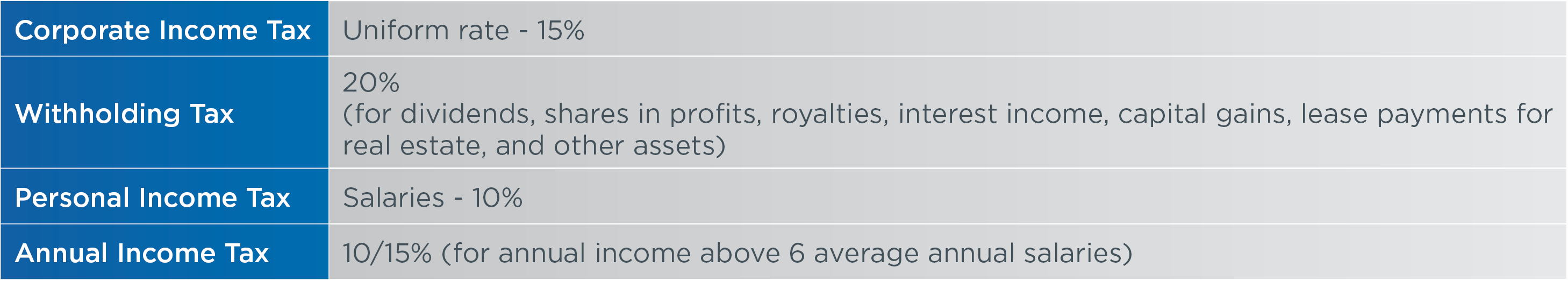

Corporate profit tax is paid at the uniform rate of 15%. Non-residents are taxed only based on their income generated in Serbia.

The withholding tax is not applied to dividend payments between Serbian entities. For non-residents of Serbia, a 20% withholding tax is calculated and paid on certain payments such as dividends, shares in profit, royalties, interest, capital gains, lease payments for real estate and other assets.

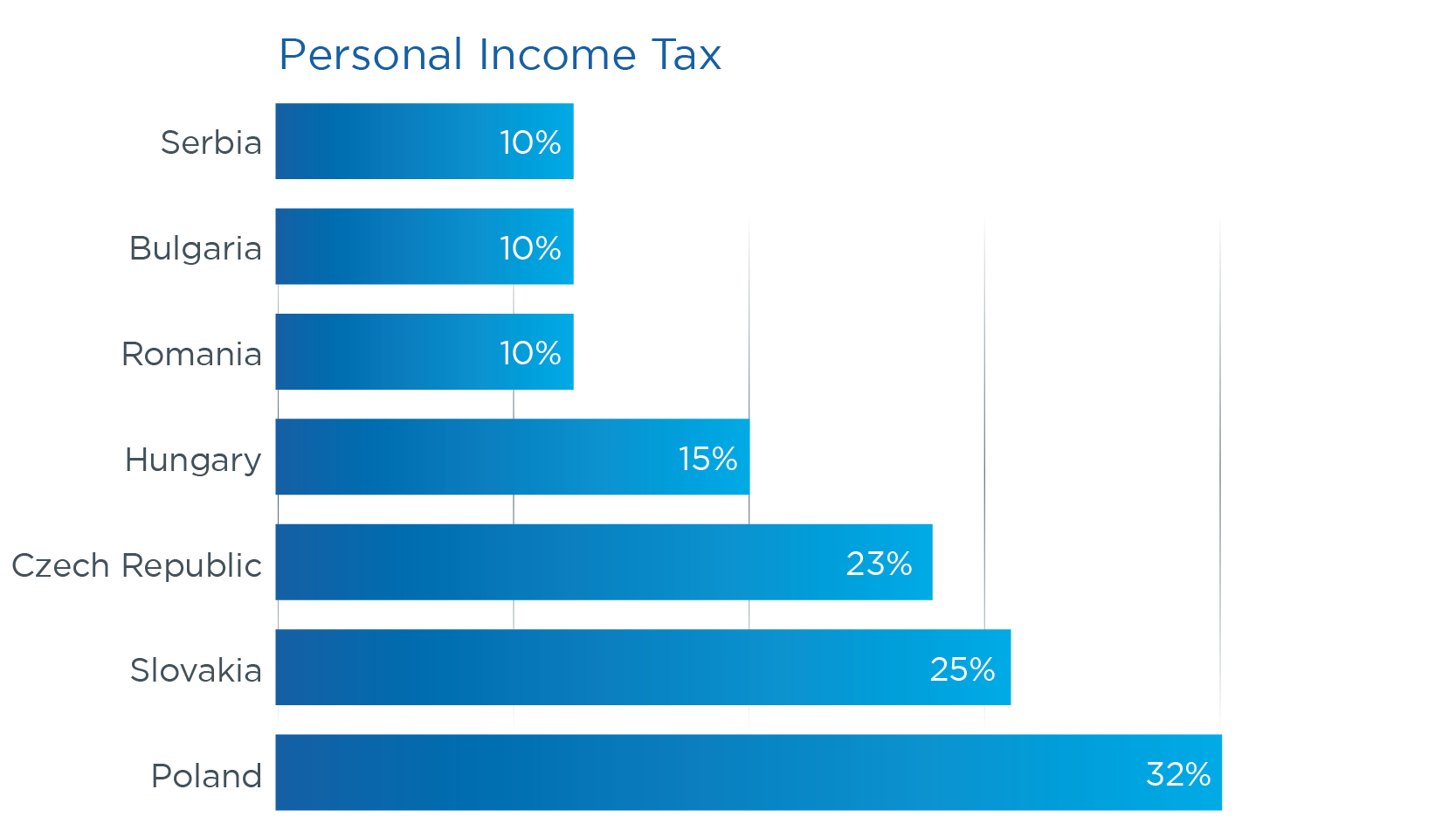

The personal income tax rate is 10% for salaries.

The annual income is taxed if exceeding the amount of threefold the average annual salary in Serbia. The tax rate is 10% for the annual income amounting up to 6 times the average annual salary in Serbia, and 15% for the part of the annual income exceeding 6 times the average annual salary in Serbia.

Taxes and Contributions

The rates for mandatory social security contributions are:

The total sum of social security contributions and income taxes that are calculated on the net income, amounts to about 65% of net earnings.

Employment of people who were registered with the National Unemployment Agency for more than 6 months entitles employers to a sizable relief of taxes paid on net salary from the moment of employment:

This reduces the total salary load to a very competitive 20%*.

*an estimate for an average salary in Serbia

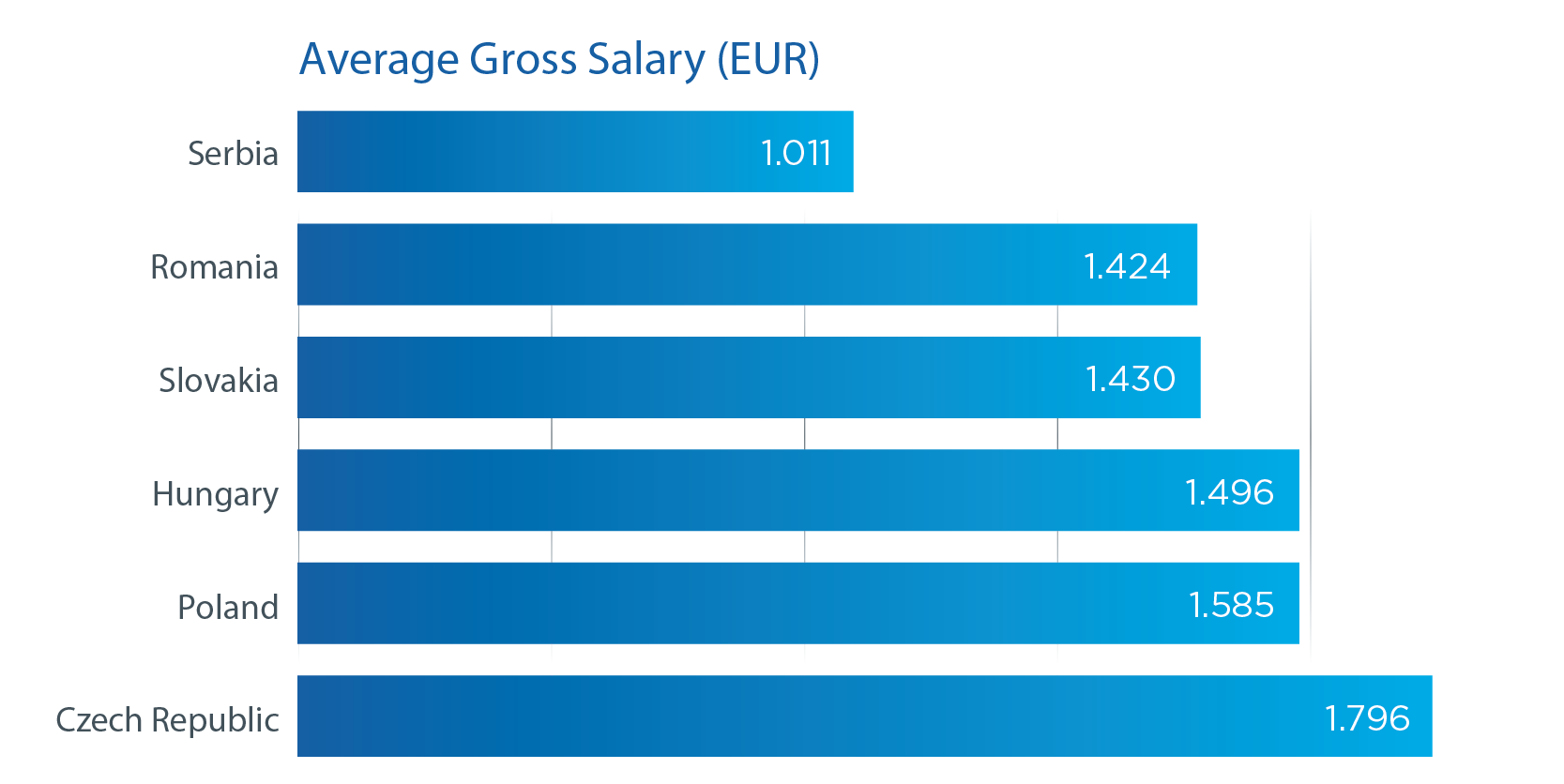

Average salaries in Serbia ensure cost-effective operating. Total costs for employers stand at merely 50% of the level in EU countries from Eastern Europe. Social insurance charges and Salary Tax amount to roughly 65% of the net salary but the tax burden for employers can be reduced through a variety of financial and tax incentives

Data: Average Gross Salary 2023; Source:The Vienna Institute for International Economic Studies, 2025

The 100% state-owned Electric Power Industry of Serbia is the sole electricity supplier at the moment. The electricity price varies according to the consumption category and daily tariff rate.

As a natural gas supplier in Serbia, the state-owned company Srbijagas pursues its pricing policy in accordance with world prices of oil derivatives and the US dollar exchange rate fluctuations. The price of natural gas is set every 15 days, currently standing between €0.38/m3 - €0.42/m3.

The waterworks in Serbia are operated at the municipality level with water prices set by local authorities.